Dubai, UAE, 21st May 2023, ZEX PR WIRE, Bitunix is a professional crypto derivative exchange that offers both spot and perpetual futures trading. In this guide, we will walk you through derivative trading and how to trade perpetual futures on the Bitunix website.

The Difference Between Spot Trading and Derivative Trading

Before we start, it’s essential to know the difference between spot trading and derivative trading.

Spot trading, also known as cryptp-to-crypto trading, is where delivery is made instantly after the buying or selling. For example, in a BTC/USDT trading pair, when you are trying to buy $100 of BTC, you actually sell $100 of USDT to get the equivalent value of BTC. After the transaction is completed, you no longer hold the $100 USDT. Instead, you hold the equivalent value of BTC worth $100, and you have direct ownership of those BTC.

However, derivative trading is essentially trading in futures contracts or options on margin, similar to those in the traditional finance market. It is similar in concept to a stock index or a contract containing a commodity contract, where investors can take risk on the future value of certain index or commodity. In crypto derivative trading, traders are expected to use USDT or other cryptos as a margin, rather than directly trade in crypto. And a cryptocurrency contract allows traders to enjoy the growth of value in cryptos without actually holding them.

For example, when you are using a 10x leverage to trade BTC/USDT contracts, you only need a margin of $1000 USDT to hold a BTC position worth $10000 USDT. When the price of BTC rises by 5%, the profit that can be achieved for that position will be (10000*5%) =$500. Since you only used $1000 USDT of margin to gain $500 USDT with a 10-times leverage, it becomes a 500/1000=50% return.

The increase of return is the result of the leverage, which allows trader only needs to pay a certain percentage of margin to hold a higher value contract. However, it’s important to remember that while using leverage, the greater the gains that may be gained, the greater the losses that may be faced. In the previous example, if the price of BTC falls by 5%, the loss is (10000*-5%)=-500 USDT, meaning the margin of $1000 USDT results in a return of -50%.

Perpetual Futures on Bitunix

As a derivative exchange, Bitunix offers USDT-Margined perpetual futures for the most popular cryptos, including BTC, ETH, BNB, and more. Perpetual futures is one of the most popular forms of crypto derivatives among crypto traders. Compared to delivery contracts, perpetual futures don’t have a delivery date, meaning that traders can hold their positions as long as they are willing to.

Step 1 – Go to Bitunix website. Click [Log In], or [Sign Up] to register one if you don’t have an account yet.

Step 2 – Click [Futures] under [Derivatives] on top of the screen.

Step 3 – Click the [Transfer] icon on the right to add funds from your Spot Account to your USDT-Margined Futures Account

Step 4- Return to the perpetual futures trading page. You will see the page below:

-

Select Futures

-

Select Margin Mode or Leverage

-

Select Open a Position or Close a Position

-

Select Order Type, Bitunix supports Limit, Market and Plan orders.

-

Enter the Price and the Amount

-

Select Buy to open a long position; or Sell to open a short position

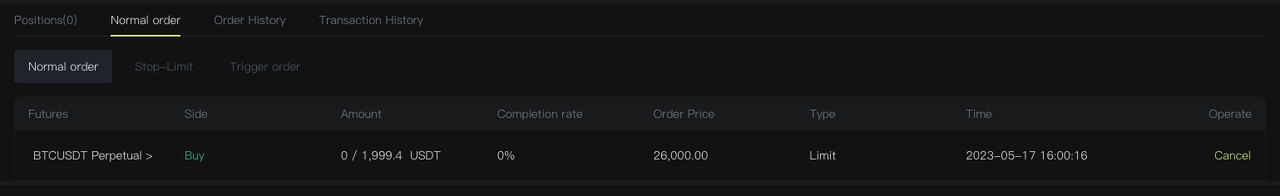

Step 5 – If your order is not filled immediately, you can view or cancel your order under [Normal Order]

Step 6 – If your order is filled, you can view your position including its open price, liquidation price, margin, PnL ratio(Profit or Loss ratio). You can also use Limit Price or Market Price to quickly close your position

Is Bitunix Safe?

Safety is always a major concern for users if they are planning to invest a significant amount of money in cryptocurrencies. There have been cases where protocols or exchanges are hacked leading to loss of assets from people’s digital wallets every year.

Bitunix crypto exchange allows users to setup multi-factor authentication to secure their accounts from any unauthorized access. In addition, Bitunix takes several secure measures on its server as well as its wallet to ensure users’ accounts and assets are safe at different levels.

It’s worth mentioning that Bitunix exchange also became a U.S. MSB registrant in late 2022 and received the SEC compliance license in the Philippines in February 2023.

About Bitunix

Founded in November 2021, the professional crypto derivative exchange Bitunix has developed steadily, as it became a U.S. MSB registrant in late 2022 and received the SEC compliance license in the Philippines in February 2023. Then it officially received $10 million in funding to fully open its global market business, with offices established in Dubai. Bitunix is now expanding its team to Latin America, Asia, and Africa, as well as Turkey, Russia, and other regions where the cryptocurrency market is growing rapidly. Bitunix aims to provide a better product experience for millions of users,aiming to become the safest crypto derivatives exchange for users. 2023 will be a year of significant transformation for Bitunix.

The Post A Guide to Trade Perpetual Futures on Bitunix Derivative Exchange first appeared on ZEX PR Wire

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]